Why does Waukesha County need a County Sales Tax?

Since 2006, our revenue has been constrained by state law, and it has not kept pace with the rising costs of providing essential services. Each year, county residents contribute approximately $1.5 billion in sales and income taxes to the state government in Madison. In return, our county receives just $60 million in state aid—ranking us as the second lowest in per capita state aid among Wisconsin counties.

How does the Waukesha County rank when compared to other 71 Wisconsin Counties?

Waukesha County State Average State High

Total Spending per capita $637 (Lowest of any County) $1,107 $2,582

Per Capita Tax Levy $289 (3rd lowest) $423 $1,347

Per Capita Debt $199 (13th lowest) $518 $2,413

Per Capita Total State Aid $148 (2nd lowest) $285 $1,039

Levy (Property Tax) Rate $1.44 (2nd lowest) $3.13 $7.14

How much will the County sales tax add to the existing state sales tax?

The County plans to increase the current 5% State Sales and Use Tax by 0.5%, resulting in a new sales tax rate of 5.5%. This rate will align with those of neighboring counties such as Dodge, Jefferson, Ozaukee, Walworth, and Washington. Even with this adjustment, Milwaukee County will maintain a higher sales tax rate than Waukesha County, with its rate standing at 5.9%. Additionally, the sales tax rate in the City of Milwaukee will remain at 7.9%. Currently, 69 of Wisconsin’s 72 counties have a county sales tax (Racine County is expecting to vote on a sales tax this fall).

How much revenue will the county sales tax generate on an annual basis?

It is estimated that a county sales tax would generate $50M-$60M per year. Roughly 20% of that money will be return to county property owners in the form of a direct reduction on the county’s portion of a property tax bill.

What will the county do with the sales tax revenue?

The County will maintain its commitment to conservative fiscal management and efficiency, principles that have allowed us to avoid implementing a sales tax for nearly 40 years. We will continue our data-driven approach, focusing on consolidations and partnerships to maximize the impact of the new revenue.

The primary goal of introducing a county sales tax in Wisconsin is to provide tax relief. Waukesha County plans to achieve this in three key ways:

1. Property Tax Reduction: We will directly reduce property tax bills to partially offset the impact of the new county sales tax.

2. Capital Expenditures: Sales tax revenue will be used to fund capital projects such as road improvements and other expenditures, which will decrease our need to borrow. This reduction in debt will, in turn, lower future property tax levies required for debt service.

3. Municipal Aid: We will allocate funds to municipalities to help them reduce local property taxes.

What will be the net financial impact of the county sales tax on a property owner?

For a typical homeowner, the net impact of the new sales tax will be approximately $7.25 per month. This is because the sales tax will be partially offset by a reduction in property taxes. Without the property tax adjustment, the monthly impact of the county sales tax would be around $12.

How will the sales tax reduce County Property taxes and when would a property tax cut be in place?

Up to 20% of sales tax collections (estimated $12 million if sales tax collections reach $60M) would go toward a direct reduction of property tax bills partially offsetting the impact of the sales tax on property owners. With the property tax cut in place the impact of the sales tax on a homeowner drops from about $12.00 per month to roughly $7.25 per month. The tax cut will appear on the December 2026 tax bills.

If enacted, would the county restore all the cuts and position reductions that have taken place over the past decade?

No. The primary use of any county sales tax revenue is tax reduction. County would not abandon the fiscally conservative principles that have made it the lowest taxed, lowest spending per capita county in Wisconsin. The restoration of any cuts in services or positions would be determined by the same data-driven approach that led to the reductions in the first place. Should a department request the re-funding or re-creation of a position, the County Executive and the County Board would consider it through the established budget process.

How many other counties have implemented a sales tax?

69 of Wisconsin’s 72 counties have already implemented a sales tax. Racine County has announced plans to add a sales tax by the end of this year. If that happens, only Waukesha and Winnebago counties would be without a 0.5% county sales tax.

How will the 0.5% County sales tax impact the cost of my purchases?

The new county sales tax will apply only to items already subject to the state’s existing 5% sales and use tax. The additional 0.5% county tax would add just $0.01 (one cent) to a $2.00 purchase, $0.10 (ten cents) to a $20 purchase, $10 to a $2,000 purchase, and $100 to a $20,000 purchase. Revenue generated from this county sales tax will be used to reduce property taxes.

How does a county sales tax impact out-of-county workers and visitors?

The equivalent of 37% of the County population live outside of the County but come into the County to work using county roads and other county services. Visitors and out-of- county workers would pay a significant portion of the total collected sales tax revenue.

How has the public been involved in the decision to implement a County sales tax?

Involving the public in the county’s budget process has always been an important part of our fiscal management strategy, and the decision to explore a County sales tax was no exception. In the spring of 2024, the County Executive established a Budget Task Force consisting of 34 Waukesha County residents, including several County Board Supervisors, municipal officials, business leaders, and members of the public. The Task Force evaluated the county’s future needs for buildings, roads, infrastructure, and

operations, reviewed the revenue options permitted under state law, and provided recommendations to the County Executive and County Board for managing the budget over the next 5 to 10 years.

In addition to the Task Force’s work, the County Executive and the County Board of Supervisors have been actively engaging with residents at various events across the county, discussing the fiscal challenges we face and exploring potential solutions.

How does the county sales tax help local municipalities?

Up to 20% of the County’s sales tax revenue will be allocated to municipalities to help reduce local property taxes. Like the County, all cities, towns, and villages in Waukesha County are subject to state-imposed levy limits and are under significant financial pressure to provide essential services to their residents. In addition to the direct reduction in property taxes, the County will make payments directly to municipalities to alleviate the local tax burden. The specific amounts allocated to each municipality will be determined actual county sales tax collections and will be distributed based on municipal population starting in 2027. Future municipal payments will be reviewed every two years, in line with the state budget cycle, and will be set in conjunction with the corresponding county budget. A table of estimated municipal aid Link here. Actual sales tax collections may vary.

What is the timeline for the sales tax and when would the new 0.5% County sales tax take effect?

The sales tax proposal was reviewed and considered at a joint meeting of the County Board’s Finance and Executive Committees on Monday, October 14, 2024. The Finance Committee supported the proposal with a 5-2 vote, and the Executive Committee supported the proposal 6-0. The full Waukesha County Board of Supervisors will vote on the measure on Tuesday, October 22, 2024. The ordinance enacting the sales tax calls for it to begin on July 1, 2025.

Does enacting the sales tax require a countywide referendum?

No. Wisconsin Statute Section 77.70 authorizes Wisconsin counties to enact a county sales and use tax by adopting a county ordinance. To pass, the ordinance would need to garner the support of the majority of Waukesha County Board Supervisors.

Is Waukesha County facing a financial hardship?

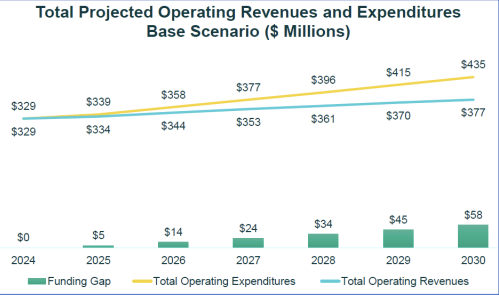

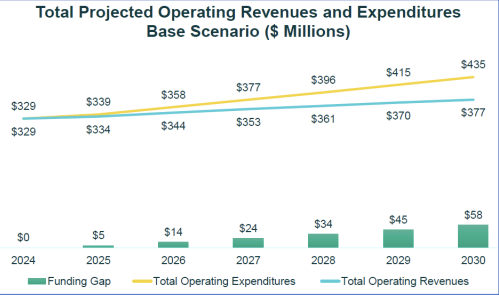

While Waukesha County has adhered to an award-winning, fiscally conservative approach to budgeting and financial management, like all local municipalities, the county has made tough decisions to cut services in order to effectively manage the high cost of inflation and conform with state regulations and mandates. Despite the county’s track-record fiscal prudence, the state imposes limits on the amount of taxes the county can levy each year. That formula-based limit results in levy increases that are far below what the county needs to operate our government and has led to yearly cuts in services and an estimated $5M annual shortfall. In recent years County departments have made millions of dollars in cuts in services and personnel including the reduction of Sheriff’s Deputies and Sheriff’s Department staff and public works employees. If unaddressed, the budget shortfall would grow to $58M in 2030.

Why is the County not pursuing a vote on a referendum to increase the County tax levy?

The County decided against pursuing a countywide referendum to exceed the state-imposed levy limit for several key reasons.

Firstly, a referendum would only provide a temporary solution, failing to address the long-term structural challenges created by years of revenue limits and inflation. In contrast, a sales tax offers a more sustainable approach by generating revenue from both residents and non-residents and will grow over time, unlike a referendum which would impose a tax increase solely on county property owners. Importantly, the County’s proposed sales tax would reduce property taxes rather than increase them.

Secondly, a referendum does not offer support to municipalities that are also grappling with financial difficulties.

Finally, the referendum option was the least favored among the various legal alternatives considered by the County’s Budget Task Force, with only 25% of its members endorsing it. In contrast, the County sales tax proposal received majority support from the Task Force, making it the preferred choice for addressing the County’s financial needs.

Why isn't the County considering a sales tax below 0.5%?

Current state law mandates that counties, except Milwaukee County, can only impose a sales tax rate of 0.5%. A rate lower than 0.5% is simply not a legal option. To change this, new legislation would need to be introduced, passed by both houses of the state legislature, and signed by the Governor. Only then could any of the remaining counties implement a lower rate.

This concept was first discussed during Budget Task Force meetings last summer. Since then, the County has engaged with Wisconsin legislators and legislative leaders. However, several obstacles emerged that make amending the current law difficult and could even lead to broader tax increases statewide:

• Levying less than the full 0.5% sales tax would not generate enough revenue for the County to offer a significant property tax cut to offset the new sales tax burden

• It would also limit the County’s ability to provide financial assistance to local municipalities that are facing similar fiscal challenges

• A reduced rate would be only a short-term fix, likely forcing the County Board of Supervisors to revisit the sales tax rate within a few years

• State legislators have indicated that they will not support additional shared revenue or funding for mandated court services until the County adopts the full 0.5% sales tax. This stance is unlikely to change if the County pursues a lower rate

• Proposing any changes to the county sales tax statute could lead to amendments that increase county sales taxes statewide. For example, the legislature and the Governor recently supported

raising Milwaukee County's sales tax to 0.9%, which could become the new standard for other counties • Additionally, the Wisconsin Counties Association (WCA) supports a 1.5% county sales tax as part of its legislative platform. If a bill to amend the sales tax statutes were introduced, the WCA would likely push for this higher rate